1️⃣ Howto Understand the Growth of Solar Power?

To determine if solar energy is truly growing, it is important to look at the global energy production landscape.

By analyzing the top three energy-producing countries in the world—China, the United States, and India, we can understand the larger trends.

✅ Why these three countries?

- China: The world’s largest producer of electricity, heavily focusing on expanding renewable energy.

- United States: Nearly half of all new renewable energy installations are solar, demonstrating rapid growth.

- India: With its rapidly growing economy, the demand for solar energy is also increasing sharply.

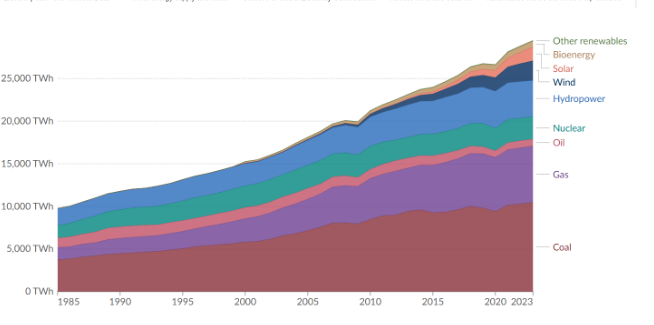

2️⃣ Which Energy Sources Are Actually Growing Globally?

Among global energy sources, the ones showing significant and meaningful growth are solar, wind, and bioenergy.

| 🌞 Solar | Rapid expansion, increasing capacity annually | Zero carbon emissions |

| 🌬️ Wind | Expansion in both onshore and offshore wind | Zero carbon emissions |

| 🌿 Bioenergy | Gaining attention as an eco-friendly fuel | Carbon neutral possible |

In contrast, coal and natural gas are likely to be phased out gradually due to carbon emissions.

Especially with many nations setting 2050 carbon neutrality goals, renewable energy is becoming more prominent.

3️⃣ How Are China and the U.S. Growing Their Solar Markets?

China is moving away from traditional fossil fuels and is heavily investing in renewable energy sources.

In 2023, China's solar power capacity growth reached an all-time high.

Although it has also experimented with hydropower, drought issues have made solar energy a better choice for expansion.

The United States is also rapidly increasing its solar capacity.

In fact, almost half of all new renewable energy installations in the U.S. are solar, highlighting its growing importance.

🇨🇳 China's Renewable Energy Expansion

- World’s largest producer of electricity

- Transitioning from fossil fuels to solar and wind energy

🇺🇸 U.S. Renewable Energy Focus

- 50% of new renewable energy installations are solar

- Shifting the energy production paradigm towards clean energy

4️⃣ What Are Solar Panels Made Of?

T he main raw material for solar panels is Polysilicon.

But how has the price of polysilicon been moving?

Surprisingly, the price of polysilicon has been dropping.

You might think that with increasing solar demand, prices should rise,

but China’s aggressive market entry has significantly impacted prices.

📌 Why Did Prices Drop?

- As the solar market grew, Chinese companies flooded the market with polysilicon production.

- This led to oversupply, causing prices to fall.

⚠️ Future Scenario:

- If oversupply continues, a "chicken game" may emerge.

- Only the strongest companies will survive, eventually dominating market share.

5️⃣ Future Outlook – Who Will Be the Winner?

- Growth of the Solar Market:

- Both China and the U.S. are aggressively expanding renewable energy.

- When the top two energy consumers in the world move in the same direction,

it solidifies the global growth of solar energy.

- Importance of Polysilicon:

- Prices are temporarily low due to oversupply,

but only resilient companies will survive the competitive landscape. - These surviving companies are likely to capture larger market shares.

- Prices are temporarily low due to oversupply,

- Next Steps:

- Now we need to look at the market share of solar panel manufacturers.

- Who will survive? Who will lead the market?

💡 InConclusion

Solar energy is becoming the leader of green energy, driven by significant investments from China and the United States.

The decline in polysilicon prices is due to temporary oversupply,

and ultimately, the strongest companies will emerge as market leaders.

☀️ Investment Strategy Focused on the Solar Industry – Where and How to Invest?

1️⃣ The Growth of the Solar Industry – Now is the Opportunity

Solar energy is not just an alternative energy source.

It has become a core energy solution for achieving the 2050 Carbon Neutrality goal.

Major energy-producing countries like China, the United States, and India are rapidly transitioning to renewable energy.

- China is the world's largest electricity producer and is pushing solar power as a national strategy.

- The United States is expanding solar energy rapidly, with almost half of its new renewable energy installations coming from solar.

- India is also experiencing explosive growth in solar demand as its economy continues to expand.

📌 The global energy trend is shifting!

Solar, wind, and bioenergy are becoming the core of future energy.

2️⃣ Investment Strategy Direction – Where Should You Focus?

✅ 1. Solar Panel Manufacturers

The core of solar power generation is the solar panel.

The main raw material for these panels is Polysilicon,

a market largely dominated by China but with intense competition.

Recommended Investment Targets:

- First Solar (FSLR): A U.S.-based solar panel manufacturer known for developing high-efficiency panels.

- JinkoSolar (JKS): The largest solar panel manufacturer in China, expanding its global market share.

- Canadian Solar (CSIQ): Provides solar solutions to over 150 countries worldwide.

🚀 Growth Points:

- As the demand for solar power increases, the revenue of solar panel manufacturers is expected to grow.

- Especially, large-scale projects from countries with carbon neutrality goals will boost growth.

✅ 2. Polysilicon Manufacturers

Polysilicon is the key material for solar panels, mainly produced by Chinese companies.

However, due to overproduction, its price has dropped,

raising the possibility of a "chicken game" (extreme competition that forces weaker players out).

Recommended Investment Targets:

- Daqo New Energy (DQ): A major Chinese polysilicon manufacturer.

- GCL-Poly Energy (3800.HK): Known for its strong production capacity in the global market.

🔍 Investment Points:

- After the chicken game, surviving companies are likely to monopolize the market.

- If polysilicon prices rebound, their profitability could skyrocket.

✅ 3. Solar Power Plants and Infrastructure Companies

Companies that install, maintain, and expand solar power plants are also expected to grow significantly.

Those focusing on renewable energy infrastructure will be the major beneficiaries.

Recommended Investment Targets:

- NextEra Energy (NEE): The largest renewable energy producer in the United States.

- Brookfield Renewable Partners (BEP): Invests in solar and wind power infrastructure.

- Enphase Energy (ENPH): A leader in solar inverter technology for energy systems.

🔎 Investment Points:

- Benefits from government policies promoting green energy.

- Secure long-term revenue through large-scale project contracts.

3️⃣ Key Considerations When Investing in Solar Energy

- Polysilicon Price Volatility:

- Prices have dropped due to oversupply from China.

- However, after the "chicken game" ends, surviving companies may see prices surge.

- Supply adjustment could significantly improve profitability for key manufacturers.

- Government Policy Changes:

- Renewable energy policies of each government have a major impact on the solar industry.

- If carbon neutrality goals are maintained, it will be highly favorable for the mid-to-long term.

- Technology Advancement:

- Solar panel efficiency is constantly improving through new technologies.

- If new technologies emerge, companies relying on outdated methods may fall behind.

4️⃣ Conclusion – Why You Should Invest in Solar Energy

🌞 Solar energy is growing faster than any other green energy source,

driven by aggressive investments from China and the United States, placing it at the center of the global energy market.

💡 Investment Strategy Summary:

- Long-term investment in solar panel manufacturers

- Focus on competitive polysilicon manufacturers

- Secure stable revenue through investments in power plants and infrastructure companies

Green energy is no longer a choice; it's a necessity.

With global carbon neutrality goals and technological innovations,

the solar industry is poised to be the strongest growth engine over the next decade.

'economy' 카테고리의 다른 글

| Margin Call – The Warning Signal in Credit Trading (0) | 2025.05.13 |

|---|---|

| Summary of This Week's Global Economic Highlights (0) | 2025.05.12 |

| Warren Buffett's Key Investment Strategies (0) | 2025.05.11 |

| Analysis of Global X Defense Tech ETF (SHLD.US) (0) | 2025.05.11 |

| The Behind-the-Scenes of the U.S.-China Negotiations (0) | 2025.05.11 |